Grow your savings

Earn upto 7.75% p.a.* interest on Fixed Deposits for Senior Citizens and 7.10% p.a. on Regular

24/7 access, higher interest rates, wide range of services and more with our digital savings account!

Customised premium banking solutions that make your banking experience seamless and enjoyable

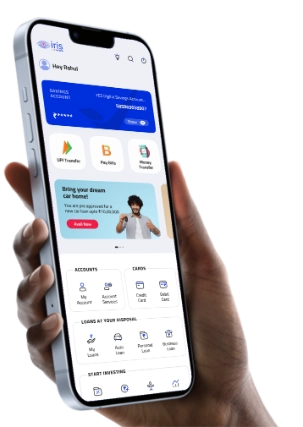

Experience the convenience of easy money management and swift bill payments, all at your fingertips

Easier

payments

With IMPS/NEFT/RTGS/UPI make easier hassle-free payments

Better card

management

Manage your debit & credit card information from the convenience of your mobile

Account services

Avail FD/RD services, access demat account transactions and a host of other non-financial services on the go

A savings account is a type of bank account that allows individuals to deposit and withdraw money with ease, while allowing them to earn interest on the balance.

The interest rate on your savings account balance varies according to the policies set by the Reserve Bank of India (RBI). It is advisable to check the prevailing savings account interest rates here.

When choosing the best savings account for you, consider key factors such as minimum balance requirements, fees & online account banking features. Evaluate these aspects to ensure you find a savings account that meets your needs and allows easy management through online platforms.

Please find below a range of savings accounts that cater to various needs. There are several common types available, including:

The interest earned on your savings account is typically deposited or credited into your account on a quarterly basis, depending on the bank's policy and the type of savings account you have. For a detailed overview, it is always prudent to reach out to the nearest branch.

*Interest Rates are subject to change at the sole discretion of YES BANK. Please click here for

Interest Rates applicable on Savings Account.

**Savings Account Daily Balance (INR) - Applicable

Interest Rate: <=1 lac: 4% p.a. |>1 lac to < 5 lacs: 4.25% p.a. | 5 lacs to <10 lacs: 5.00%

p.a. | 10 lacs to <1 Cr: 6.00% p.a. | 1 Cr to < 10 Crs: 7% p.a.

***1 YES Rewardz is equivalent to

₹0.25. YES Rewardz redeemed once cannot be reversed. For detailed terms and conditions on YES Rewardz,

please visit: https://www.yesrewardz.com.

For amounts of INR 10

Crs and above, please contact the branch or your designated Relationship Manager.

#Rates applicable

for 18 months to < 36 months tenure & value less than ₹2 Cr. ##Senior Citizen rates are only applicable

to resident customers.

^Loans are at the sole discretion of YES BANK. The Bank may engage the

services of agents under control/service agreement in the sales and marketing of its financial products.

Terms & Conditions apply.

^^Virtual RM services for digitally opened accounts.

YES BANK will NEVER ask you to reveal your User ID or Password. Therefore, never disclose your credentials (User ID, Password, OTP, PIN etc.) to anyone either through mail or over phone. If you receive any mail asking you to update or authenticate your User ID or Password, please DO NOT fall into the trap of putting in your Password or OTP or PIN. To know more on security tips. CLICK HERE